When It Comes To Your Family And Retirement Planning, Silence Is Not Golden

When It Comes To Your Family And Retirement Planning, Silence Is Not Golden

The holiday season is the perfect time to let your loved ones know how deeply you care about them by exploring and discussing everyone's life priorities for the years ahead -- including your retirement.

Before you roll your eyes, read on and you'll get a clear picture of how these conversations can both honor and protect family relationships. In fact, in terms of family dynamics, proactive communication can make all the difference between anxiety and peace of mind, according to the new "Family & Retirement: The Elephant in the Room" study conducted by my firm, Age Wave, in partnership with Merrill Lynch. We gathered responses from a representative sample of more than 5,000 people age 25 and older from all walks of life (including thousands of pre-retirees as well as retirees), who weighed in with their hopes and fears regarding their own retirement. (You can download the entire study report atwww.ml.com/retirementstudy.)

As I discussed in yesterday's post, one of the biggest ahas from this survey was the high level of generosity that exists within families. Brothers, sisters, children, and parents all seem willing to sacrifice some of their own financial peace of mind to help their loved ones. However, over the long term, giving more than you can really afford may not be good for anyone.

Retirement's Two Greatest Worries: To Be Broke and to Be a Burden

Our study revealed two top worries pertaining to retirement. Younger generations say their greatest worry about living a long life is running out of money to live comfortably. But older adults--and particularly women--feel just as anxious about "being a burden on my family."

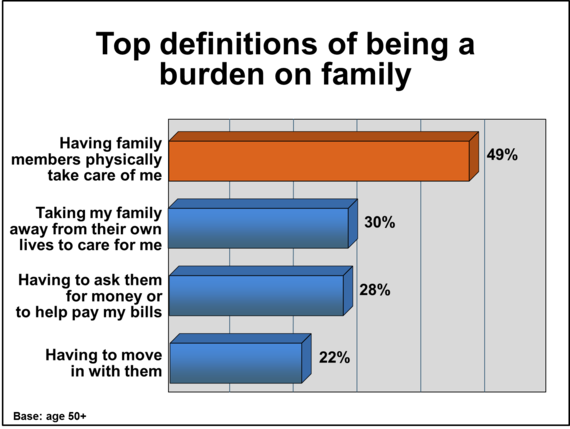

We've heard it over and over: Being a burden on one's family frightens people. But in this study, we probed deeper, asking exactly what is most worrisome. Pre-retirees and retirees agreed that having family members "physically take care of them" is something they want to avoid at nearly all costs (see FIGURE 1). As people who have been through this situation know, it is one thing to ask your adult children to help with your long-term care bills, but it is quite another to have them bathe or dress you.

FIGURE 1

A Troubling Lack of Discussion

I recently read Eleven Rings, the fascinating book written by legendary basketball coach Phil Jackson. After decades of trial and error with both the Chicago Bulls and the Los Angeles Lakers, Jackson learned that teams simply play better when the players have come to understand each other's motivations, when they are sensitive to each other's hopes and fears, and when they come together as one. In fact, Jackson pioneered the unusual practice of having his basketball teams gather together before games to sit quietly and breathe in unison.

This idea relates directly to families as well. Unfortunately, there is a dangerous absence of discussion and preventative teamwork as family members step in to help each other out. One of our focus group participants told us, "My sister and I both knew Mom's health was failing, but we just never wanted to talk about it. It was the elephant in the room. Then when she got sick, we wished we had talked about it sooner. On top of mom's illness, the family friction that erupted was a nightmare we could have avoided."

"Proactive discussions and coordination with family members can be the difference between smooth sailing and significant hardship when confronting financial challenges leading up to and through retirement," says David Tyrie, head of Retirement and Personal Wealth Solutions for Bank of America Merrill Lynch. "There is a clear benefit to having family conversations and planning ahead."

Yet very few people actually do this. I was jolted when our study revealed that only 36% of our age 50+ respondents had discussed their will or inheritance with their adult children, only 15% had discussed where they plan to live in retirement, just 13% had discussed their net worth, and a mere 10% had discussed how to pay for long-term care, if necessary. More than half had not had an in-depth discussion with their adult children about any of these retirement issues. Incredibly, nearly one-third of men and women age 50+ have not even had such fundamental discussions with their spouse.

Why? It turns out that "worry about causing family conflicts" is the top reason people give for not discussing important financial issues with family members. For too many families today, the first discussion about their aging parents' financial situation is sparked by the emergency telephone call--the one that begins, "Your dad's had a fall" or "You'd better come over to the hospital immediately."

I'm sure you see the grand irony: Lack of proactive discussion today can actually lead to people becoming a burden on their family and can create unpleasant family conflicts--the very things we most want to avoid.

Silence Is Not Golden!

There is a real need--and a substantial benefit--for thoughtful family discussion. That's especially true as people plan how they might be called upon to lend financial support to family members as they move to--and through--retirement. Maybe you'll never be in this situation. But if you are, you'll handle it better if you've done some preventative preparation. In fact, those who have had these kinds of discussions with their spouses or adult children in advance are almost twice as likely to say that they would be well prepared if they were to face family challenges. And that can surely create peace of mind and more harmony within your family.

Balancing your own retirement needs with the pressing--and often unpredictable--needs of your loved ones isn't easy. We can be caught off-guard by how significantly family dynamics can impact our retirement plans and dreams. That's why it's best to discuss these issues and make plans carefully, rather than in the middle of a family crisis. After all, the last thing anyone wants is for a lack of preparation to hurt the very people we love most.

As we roll into the holiday season, think of giving this priceless gift to your loved ones: peace of mind about your--and their--financial future. Here are some tips for how to successfully have these conversations:

- Thoughtful preparation. For example, while only 40% of us think we'll ever need long-term care, it turns out that around 70% of us eventually will. Rather than avoiding this subject, it would be a good idea to discuss three things with your family: (1) If one of us should ever need long-term care, what kind of care would be preferred and in what setting? (2) Which family members might help out and in what way? (3) How will it be paid for? This may be hard to do. But if the challenge should ever arise, both you and those you love will be far better at handling it than if you had never considered the options.

- Create a "family helping-hand fund." When saving for your retirement, consider that you may want to give a helping hand to adult children, parents, siblings, and grandchildren, whether for education, healthcare, helping to pay the rent or mortgage if they are in trouble, or just to be there for them in tough times. Think about it seriously, and discuss it with your family.

- Strike the right balance. Remember to balance your family's needs with your own retirement financial security. Just as a lifeguard struggling to swim can't help the person he's trying to save, giving too much financial assistance to family members may not only jeopardize your own retirement but also make you dependent on other family members down the road. In many lifeguard training programs, the number-one rule is don't be victim number two!

- Ask the experts. Family-related financial planning is not usually an easy, do-it-yourself project. Consult those who have been through it before. Speak to an informed financial professional and/or a workplace HR resource. Attend a retirement-planning seminar, or do some useful homework on these issues. To that end, some helpful resources are:

- "Coordinating Retirement With Your Spouse," by Emily Brandon. U.S. News & World Report (2012). Available at http://money.usnews.com/money/retirement/articles/2012/06/18/coordinating-retirement-with-your-spouse.

- "How to talk to your spouse about retirement," by Kerri Anne Renzulli. CNNMoney.com (2013). Available at http://money.cnn.com/2013/10/01/news/spouse-retirement.moneymag/.

- The Couple's Retirement Puzzle: 10 Must-Have Conversations for Transitioning to the Second Half of Life, by Roberta K. Taylor and Dorian Mintzer (2011).

- "How to Navigate Awkward Money Conversations at Your Family's Holiday Dinner," by Matt Brownell. DailyFinance.com (2013). Available at http://www.dailyfinance.com/2013/11/06/awkward-money-conversations-family-holiday-dinner/.

- "The Talk You Didn't Have With Your Parents Could cost you," by Tara Siegel Bernard. The New York Times (2013). Available at http://www.nytimes.com/2013/05/25/your-money/aging-parents-and-children-should-talk-about-finances.html?_r=0.

I'd like to know what you think. What's the best way to discuss these sensitive matters with the people you love? Are there any resources (people, websites, publications, etc.) that you've found particularly helpful? Are there any things you've done to sort these issues out within your own family?

If you'd like to watch my presentation on the transformation of retirement (or you've got a family member or friend who's sorting their way through the challenges and opportunities of this stage of life), here's a link:http://www.youtube.com/watch?v=bEDW8hSuJio&feature=youtube